Tax & Regulatory Newsletter- April 01-15, 2018

DIRECT TAX

1. Delhi Tribunal rules that domain registration fees charged by a non-resident entity is taxable as ‘royalty’ as per clause (vi) read clause (iii) of Explanation 2 to Section 9(1) because such rendering of services in connection with the use of an intangible property is similar to the trademark

Authority for Advance Rulings rules that services rendered by an oil & gas service provider in the nature of seismic data acquisition, processing and interpretation though vessels/ equipment would constitute Fixed Place PE in India even for a duration of 113 days, in absence of a corresponding specific provision under India-UAE tax treaty for such services, rejects Taxpayer’s contention for applying threshold provided for Service PE under the tax treaty, saying Service PE is not applicable for the kind of services rendered by Applicant.

INTERNATIONAL TAX

3. India, Finland settle Nokia tax row

4. UK Revisits Proposed BEPS Changes To Its Double Tax Treaties

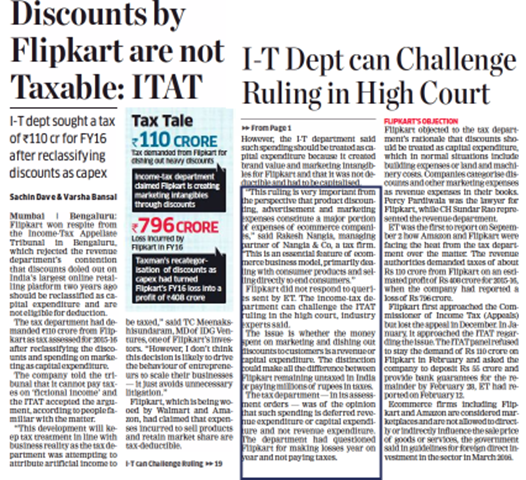

5. Looming Flipkart Tax Ruling on Discounts Creates ‘Panic’ in India

6. German Industry Cautions Against EU Digital Tax

TRANSFER PRICING

7. Delhi ITAT holds CBDT Instruction No. 3/2003, quashes TPO reference on international transaction <5 cr

HC upheld ITAT’s order, allowing overhead expense allocation by JV partners to taxpayer

ITAT directs separate benchmarking for consultancy services and explains mechanism of capacity adjustment

GST

10. No IGST on overseas trading absent importation of goods into India

We trust that you will find it interesting and informative.

Nangia & Co LLP – Tax and Regulatory Newsletter – April 01 -15, 2018