Budget Wishlist: What are the expectations of manufacturing sector’s from the budget 2017- Amit Agarwal

During Prime Minister Narendra Modi-led NDA government regime, manufacturing has emerged as one of the high focused sectors in India. And with the budget for the fiscal year 2017-18 just around the corner, everyone has set the bar high with their expectations from the Central Government on laying various reforms in the sector.

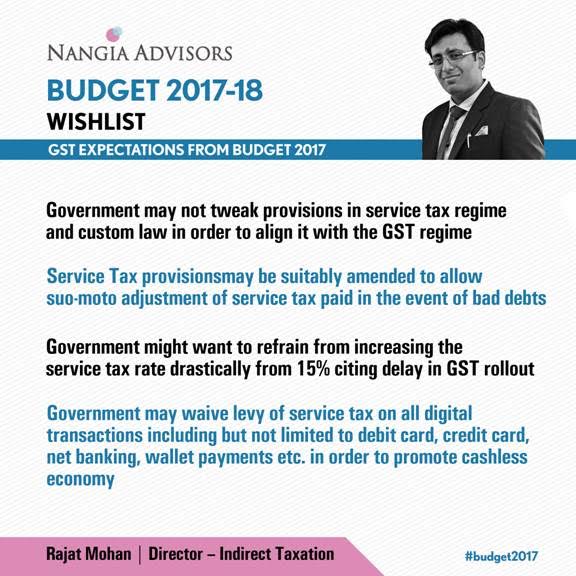

Here is Amit Agarwal, Partner, Nangia & Co sharing what are the expectations of manufacturing sector’s from the budget 2017: