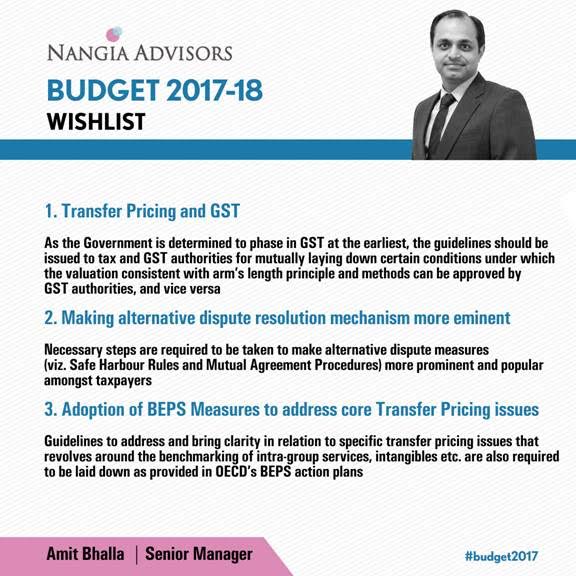

Budget Wishlist: Amit Bhalla, Senior Manager shares Key areas to be watched out in Budget 2017 from TP point of view

The Indian Transfer pricing (TP) legislation, since its inception, has attracted a lot of attention for reasons ranging from some specific peculiarities in relation to the construction of core TP issues together with disputes revolving around them over the past few years. Further, the Government of India has taken certain corrective measures to address them and to set aside the prevailing ambiguities. But a lot is yet to be done and achieved.

Here is Amit Bhalla, Senior Manager shares Key areas to be watched out in Budget 2017 from TP point of view: