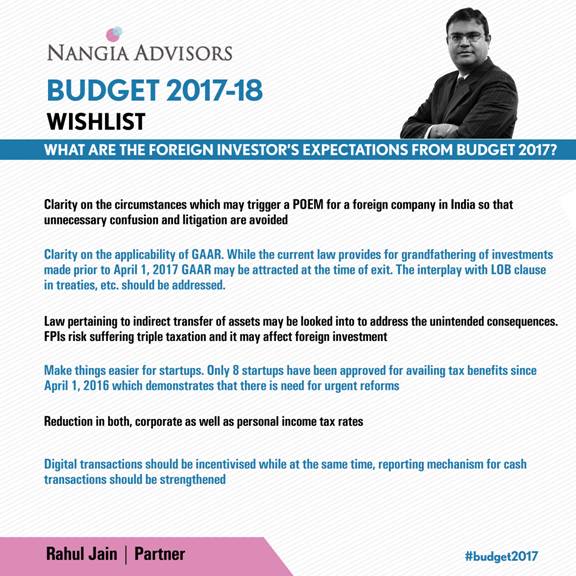

The past year has been an eventful one across economies and industries, but we look to the future with optimism and some very specific expectations for our sector. We hope that the GAAR provisions, which are expected to be introduced from

1 April, 2017onwards, are made effective prospectively for the agreements executed on or after the effective date. Furthermore, the rules for making them applicable should be objective, easy to comprehend and implement.

Rakesh Nangia, Managing Partner, Nangia & Co shares his Pre- Budget expectations for

Assocham.TV:

You can watch the videos on below links: