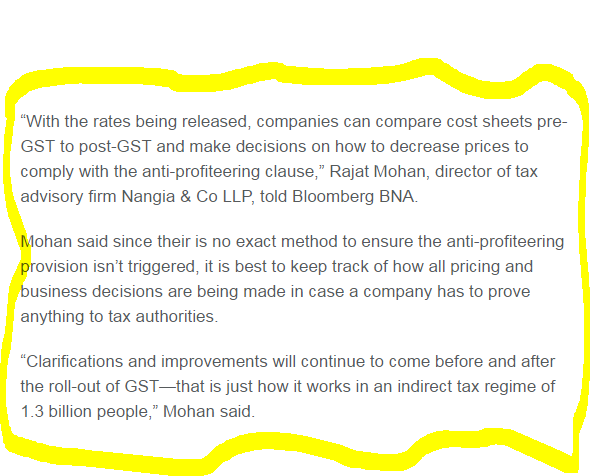

India’s Final Goods Tax Rules Leave Big Questions Unanswered- Rajat Mohan

Tax professionals are urging companies to prepare quickly for the July 1 roll-out of India’s goods and services tax regime, even though recently finalized GST rules leave big questions unanswered. State-level finance ministers charged with developing rules for the new tax regime released rate brackets May 18-19 for a full list of goods, and finalized seven of the nine draft rules.

Rajat Mohan, Director- Indirect Taxation shares his views on for India’s Final Goods Tax Rules Leave Big Questions Unanswered Bloomberg BNA.