Long term Capital Gains – decoding the new levy- Rakesh Nangia/Neha Malhotra

Dear All

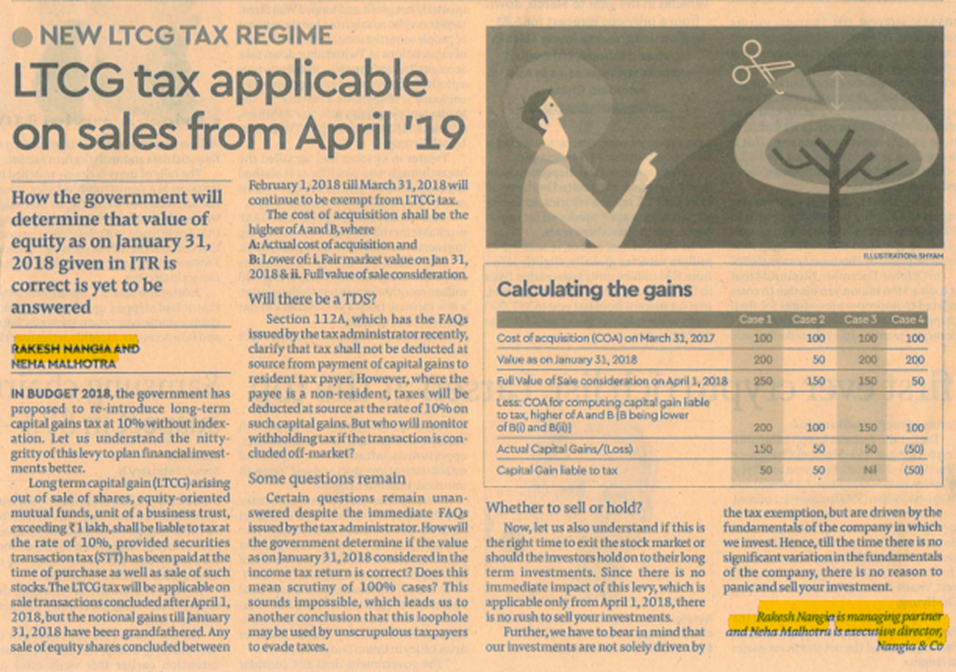

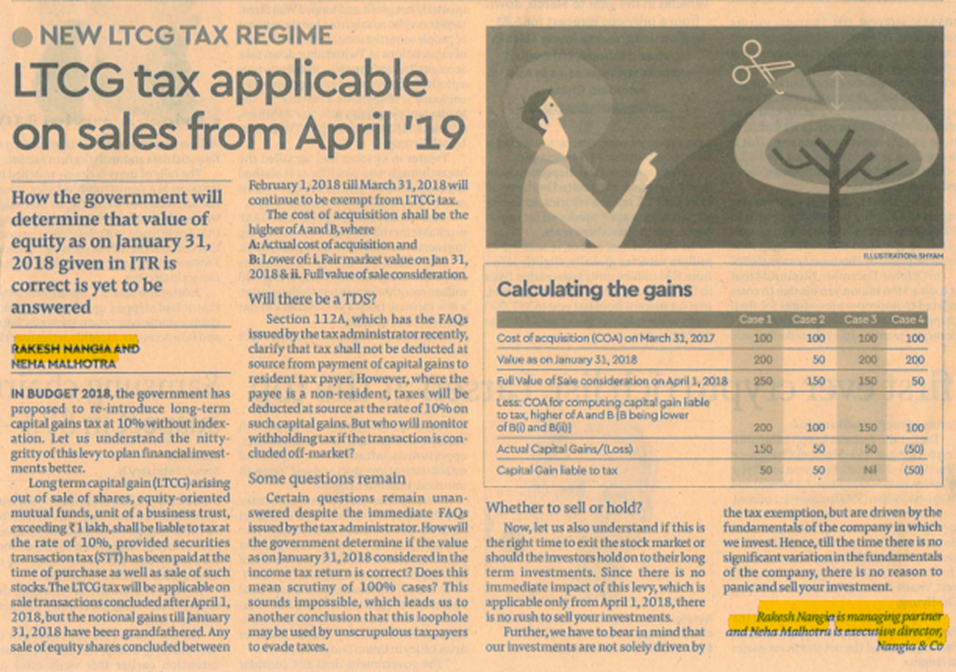

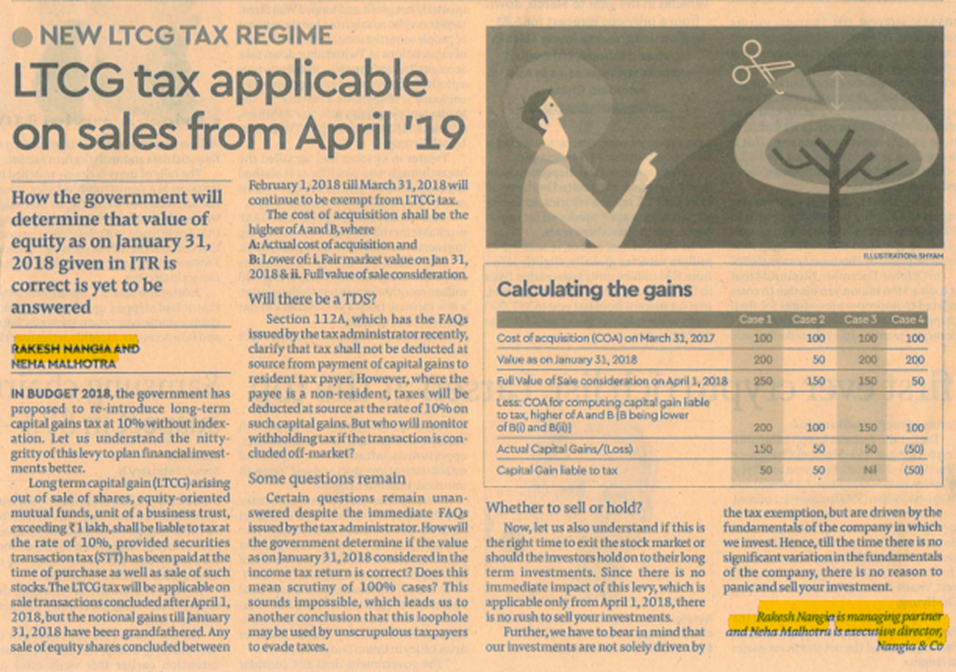

Taking the plea that Long Term Capital Gain exemption is diverting the investment from manufacturing sector to financial assets, Budget 2018 proposed to withdraw the tax exemption available on long term capital gain arising on sale of equity shares or equity oriented funds or unit of a business trust. Further, it was estimated that the long term capital gains going untaxed amounted to INR 3,67,000 Crore, which signifies a significant revenue loss for the exchequer. Hence the budget proposal seeks to minimise the economic distortion and curb tax erosion, by withdrawing this exemption.

Rakesh Nangia, Managing Partner and Neha Malhotra, Executive Director contributed an article on Long term Capital Gains – decoding the new levy for Financial Express.