Surcharge, cess come to the rescue as I-T revenues repeatedly miss target – Neha Malhotra

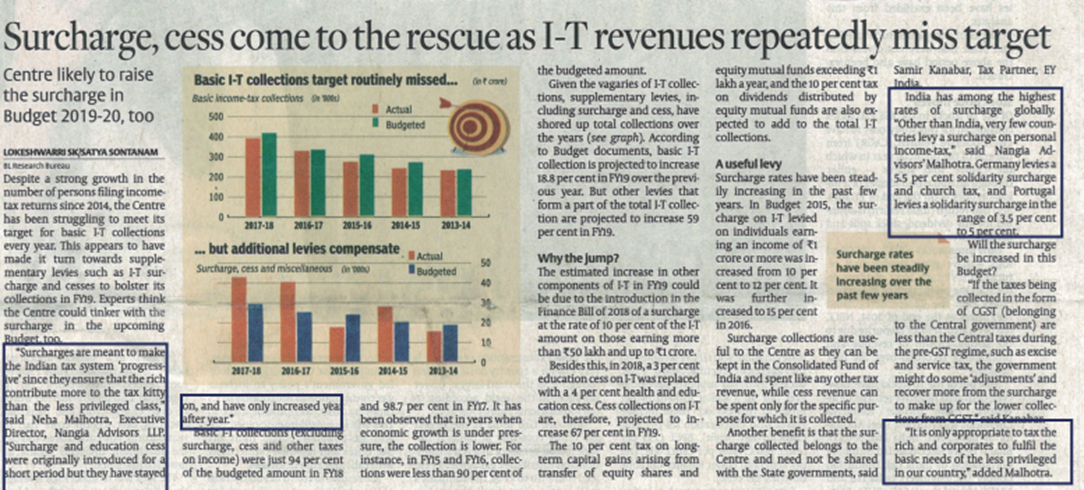

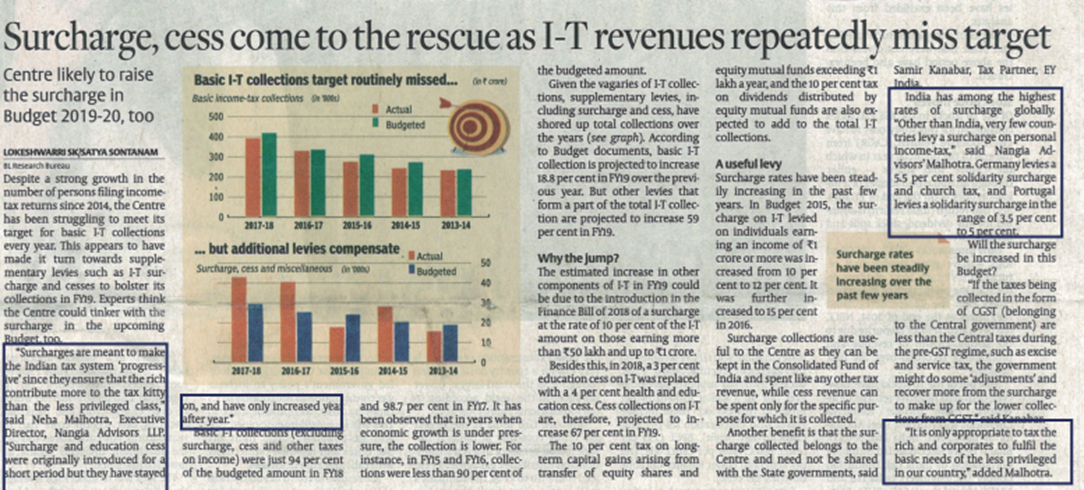

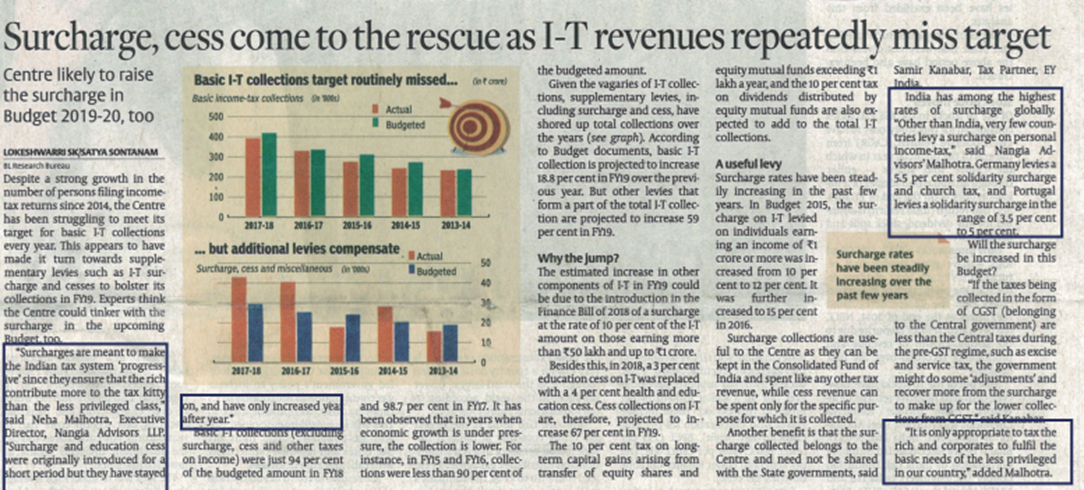

Despite a strong growth in the number of persons filing income-tax returns since 2014, the Centre has been struggling to meet its target for basic I-T collections every year. This appears to have made it turn towards supplementary levies such as I-T surcharge and cesses to bolster its collections in FY19.

Neha Malhotra, Executive Director shares her views on aformentioned story for Hindu Business Line- Front page story.