Get in touch with Experts

Vikas Gupta

Partner

Vikram Pratap

Partner

Prateek Agarwal

Partner

Jaspreet Bedi

Partner

Audit & Assurance: Overview – In conversation with Jaspreet Singh Bedi, Partner

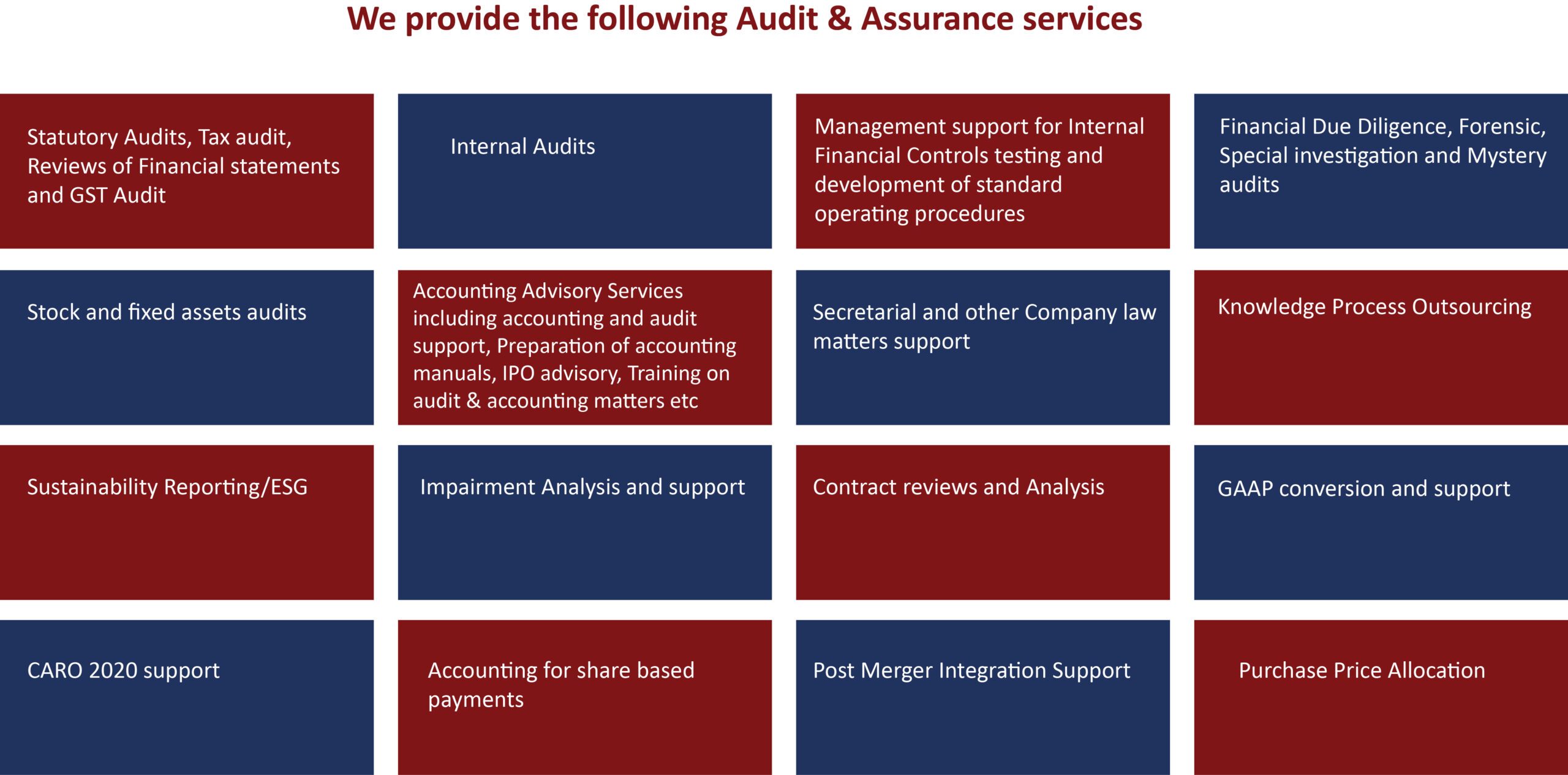

Our Service Offerings

While many of the rules of business have changed, the fundamentals haven’t. Meeting investor expectations begins with the completeness, accuracy and fair presentation of information in your financial statements and disclosures. The audit is key to sustaining confidence in both your company and the financial system at large. It must keep pace with a fast-evolving corporate reporting environment – one characterised by investor scepticism and the 24/7 scrutiny of corporate information, including non-financial information. Auditing thus involves much more than just the legal obligation of certifying annual accounts. Whether annual and consolidated accounts or special audit services and certifications, having the objective judgment of external auditors makes information more reliable for all decision makers. Our professionals at Nangia & Co have many years’ experience, competence, industry knowledge and integrity. Our audit approach, is tailored to suit the size and nature of any organization and draws upon our extensive knowledge and talent, understanding of laws, regulations and legislation. We approach your audit with a deep and broad understanding of your business, the industry in which you operate, and the latest regulatory standards, helping you deliver value confidently through transparency of your reporting to stakeholders. We are one of the very few leading firms registered with the PCAOB, USA. We have an effective Peer Review Certificate from the Institute of Chartered Accountants of India, enabling us to undertake audit work for listed and public-interest entities.

Risk management is a big concern for both audit committees and senior management in corporate internally. Internal audit is an independent management function, which involves a continuous and critical appraisal of the functioning of an entity with a view to suggest improvements thereto and add value to and strengthen the overall governance mechanism of the entity, including the entity’s strategic risk management and internal control system. Internal Audit helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. With commitment to integrity and accountability, internal auditing provides value to senior management as an objective source of independent advice. We provide accounting and auditing guidance which constitutes valuable insights for audit committees, chief financial officers, controllers, financial reporting groups, and internal audit directors.

Internal financial controls include policies and procedures adopted by the company for ensuring the orderly and efficient conduct of its business, including regulatory compliance and prevention and detection of frauds and errors, thereby covering not only the controls over reliable reporting of financial statements (more commonly known as Internal Financial Controls over Financial Reporting (“IFCFR”), but also include all other controls pervasive across the business. The Companies Act, 2013 (the “2013 Act”) has imposed specific responsibilities on the Board of Directors (“Board”) towards the company’s internal financial controls and, inter alia, requires the Board to state that they have laid down internal financial controls to be followed by the company and that such internal financial controls are adequate and were operating effectively. By placing more accountability and responsibility on the Board and Audit Committee with respect to internal financial controls, the 2013 Act attempted to align the corporate governance and financial reporting standards with global best practices. With adequate and effective internal financial controls, some of the benefits that the companies are experiencing include:

- Senior Management Accountability

- Improved controls over financial reporting process

- Improved investor confidence in entity’s operations and financial reporting process

- Promotes culture of openness and transparency within the entity

- Trickling down of accountability to operational management

- Improvements in Board, Audit Committee and senior management engagement in financial reporting and financial controls

- More accurate, reliable financial statements

- Making audits more comprehensive

At Nangia & Co, we help you identifying risks as well as giving you the certainty that you are making the right decisions for the future of your business. We review the Risk control matrix and suggest the process and operational improvements. We also assist in implementing new processes and controls or enhancing existing processes and controls in areas such as: – Risk assessment, including fraud risk assessment – Information quality, including Information Produced by Entity (IPE) – Monitoring and oversight of third party service providers – Precision of management review type controls – Use of analytics in the context of control activities and monitoring. We also advise management on potential opportunities to leverage control framework in other operational or compliance functions. We also perform independent testing for management and report to the management with the customized action plan.

We provide comprehensive due diligence services involving Business, Financial, Tax and Legal diligence (either in-house or through our network partners) to identify idiosyncratic business, financial risks and opportunities. Effective Due Diligence depends on identifying and then managing significant transaction issues, anticipating and identifying potentially important risk and negotiation issues. It is imperative to have reliable, timely and qualitative information in any potential transaction to enable informed decision making. The success of the investigation to make a well-informed decision would lie in a well-planned, integrated and coordinated detailed enquiry procedures. All the documents of the firm are assembled and reviewed, the management is interviewed and a team of financial experts analyse the information to see if the business is worth buying. In addition, financial due diligence analyses the assets and liabilities to be acquired. Due diligence includes a critical review of the target company’s financial statements for the past several years and a review of the financial projections for the coming years. Other areas which are analysed are:

- Key contracts.

- Financial statements.

- Employment agreements.

- Minutes and consents of the board of directors and shareholders.

- Patents, copyrights, and other intellectual property-related documents.

- Licenses and permits related to the operation of the business.

Further it is precisely in difficult economic times that preventing and investigating financial crime such as embezzlement, fraud and corruption becomes particularly important. We can assist you to manage risk, investigate alleged misconduct and fraud and measure the financial implications of disputes. If an instance of unusual financial activity is suspected, our team can conduct forensic investigations, audits, and third party due diligence by leveraging forensic technology to uncover any irregularities, keeping in mind the sensitivity and urgency required. We can assist you in the following:

- Detailed process reviews including review of soft data related to accounting and operations to test for any malpractice or suppression.

- Expense verification including reviews to check for overstatement or fictitious expenditure used to siphon out money or understate revenue.

- Detailed analysis of physical invoices to test their authenticity and correctness.

- Forensic study of email boxes, to understand email culture and check for transfer of information critical to an organization.

- Mystery Audits

Stock and fixed assets Audit is also an area of specialization and core competence for Nangia & Co. Stocks and physical assets such as raw materials are critical real assets and needs systematized management. As a large number of companies are operating across the borders through multiple locations and channel partners, making asset management a challenge. We aim at delivering focused services to companies to keep their physical assets check intact.

We at Nangia & Co can assist you anticipate the impact of key business decisions on your accounting and financial reporting. We have a multidisciplinary team of accounting, tax, and IT professionals with deep, sector-specific experience in managing the implementation of accounting changes, ranging from a single accounting standard to the full project planning. We can assist you in preparation of accounting manuals, IPO advisory, Training on audit & accounting matters etc.

The regulatory framework is always changing, making this environment increasingly complex and confusing for businesses. Regulations at national, international and supranational levels are being issued, amended or expanded, which sometimes makes it hard to navigate through the maze of orders, decrees, guidelines and circulars. This is not helped by the fact that businesses also need to assess the potential effects of future regulations. Their professionals can help you manage compliance risks, an operation essential to achieving lasting business success today, as compliance breaches can cause considerable damage, which may even put the future of a company at risk.

We provide our clients with all of the accounting and bookkeeping services they need. We can assist you with setting up a bookkeeping system and producing efficient accounting records, such as journals, ledgers, and financial statements. We review financial records, provide advice for money management, help with budgeting, and offer advice on any financial decision. Competence and experience enables us to offer a wide range of Outsourcing Solutions to our clients, helping them to manage heavy workloads. Taking peace of mind as an ideal, we offer an efficient helping hand to our clients. We virtually operate as your back office for all your bookkeeping and accounting services