Dear All

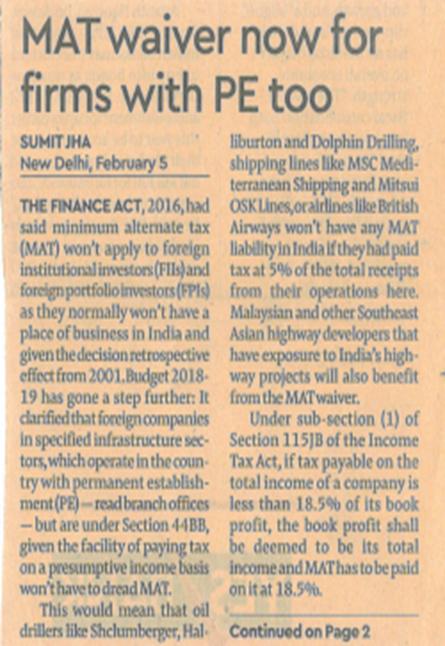

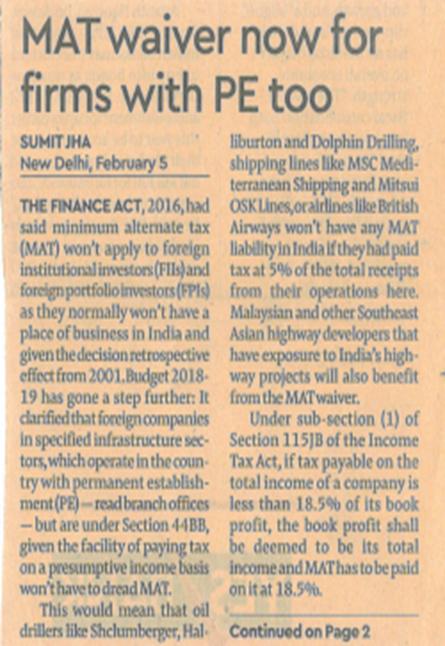

Budget 2018: The Finance Act, 2016, had said minimum alternate tax (MAT) won’t apply to foreign institutional investors (FIIs) and foreign portfolio investors (FPIs) as they normally won’t have a place of business in India and given the decision retrospective effect from 2001. Budget 2018-19 has gone a step further: It clarified that foreign companies in specified infrastructure sectors, which operate in the country with permanent establishment (PE) — read branch offices — but are under Section 44BB, given the facility of paying tax on a presumptive income basis won’t have to dread MAT.

- Shailesh Kumar, Director- Direct Taxation shares his views on aforementioned story for Financial Express.

- Suraj Nangia, Partner shares his views on the queries raised by Financial Express readers.