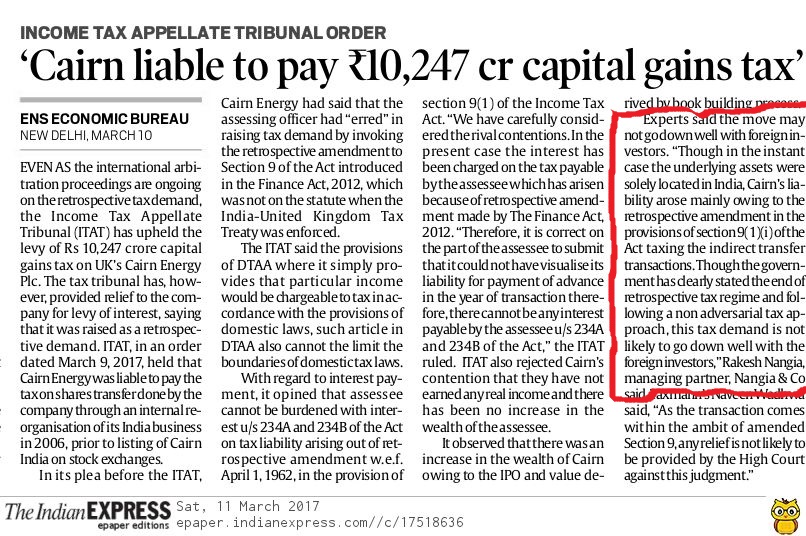

Setting the stage for a prolonged legal battle, the Income Tax Appellate Tribunal (ITAT) has ordered UK’s Cairn Energy Plc to pay Rs 10,000 crore capital gains tax on transfer of ownership from Cairn UK Holdings to Cairn India. The order comes at a time when an arbitration between the company and the Indian government is already going on in Singapore.

Rakesh Nangia, Managing Partner shares his views on aforementioned story for following publications:

- Economic Times- Front page story

- Business Standard- Front page story

- Indian Express

- Bloomberg Quint

- Calcutta Telegraph