Dear All

The Union Budget 2018 was a Budget focused on the country’s growth prospectus but, as expected earlier, was stressed on addressing agrarian crisis, including infrastructure development, diversification, and pro-poor measures.

Rakesh Nangia, Managing Partner shares his views on Budget 2018 for following publications:

· Mr. Nangia shares his take on Budget 2018: Most companies to pay 25% corporate tax for Financial Express

· Mr. Nangia shares his take on Budget 2018: How LTCG tax on equities comes back for Financial Express.

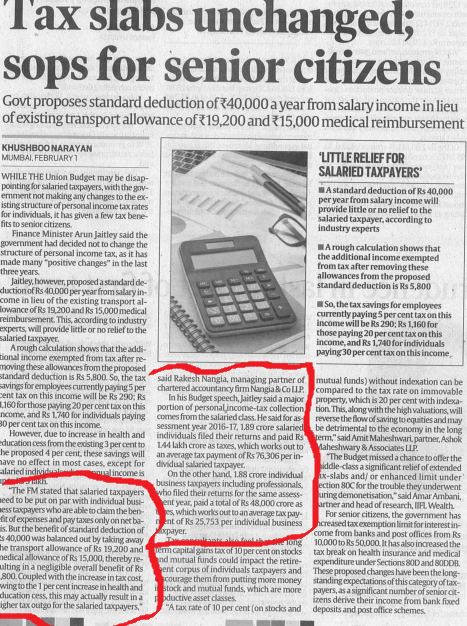

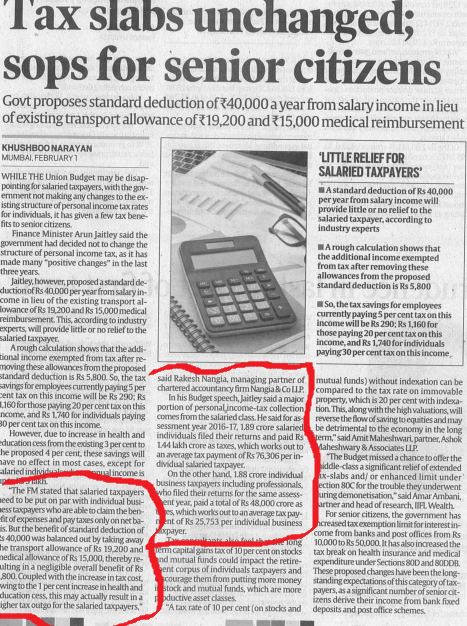

· Mr. Nangia shares his take on Budget 2018: Income Tax: Tax slabs unchanged for Indian Express.

· Mr. Nangia views on Know how Budget announcements affect your finances for Zee business.

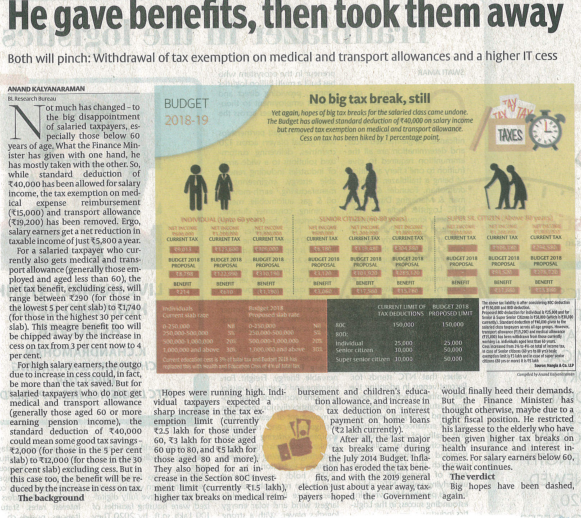

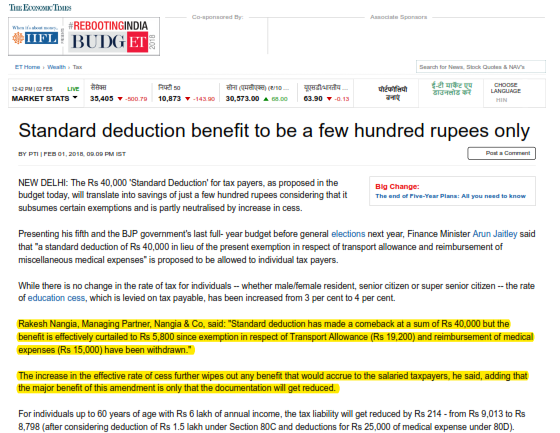

· Mr. Nangia shares his views on Standard deduction benefit to be a few hundred rupees only for Economic Times.

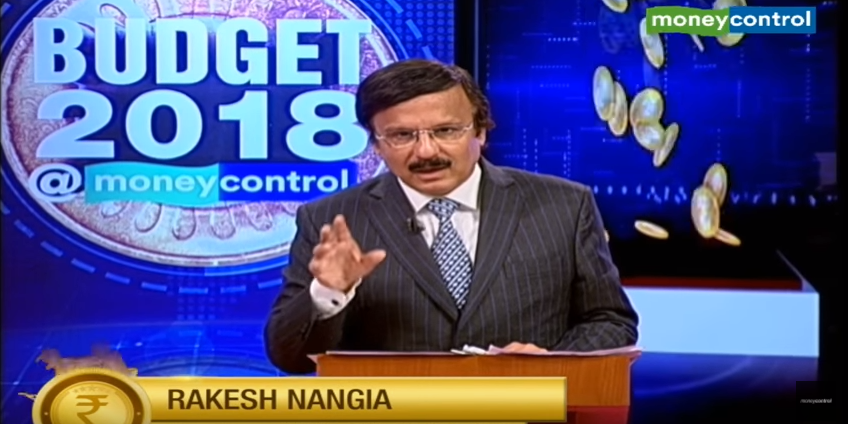

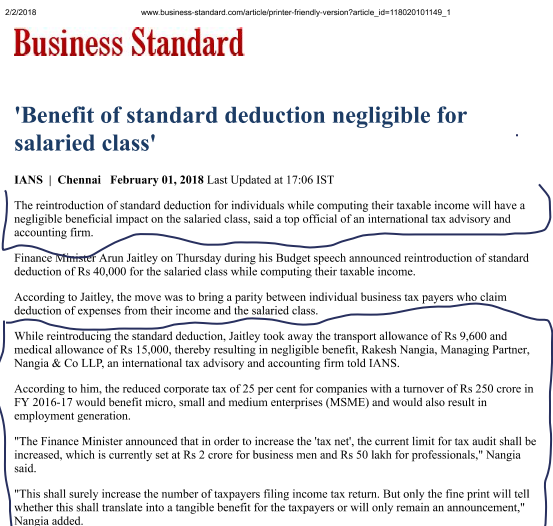

· Mr. Nangia shares his views on ‘Benefit of standard deduction negligible for salaried class for Business Standard

· Tax calculations data sheet on personal tax carried in Hindu Business Line

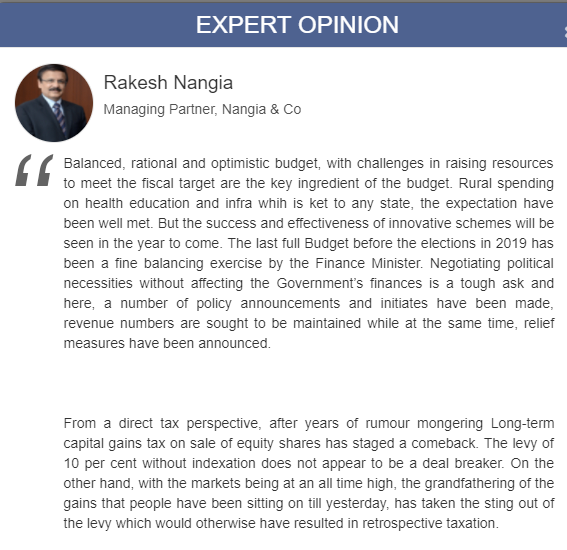

· Mr. Nangia shares his views on Budget 2018 for Taxsutra

· Mr. Nangia shares his views on Budget 2018 for Taxmann

· Mr Nangia shares his views on budget 2018 for PTI( two stories).

(News flashed by PTI has been picked up 188/135 other news publications)

· Mr Nangia shares his views on budget 2018 for IANS

(News flashed by IANS has been picked up 52 other news publication)

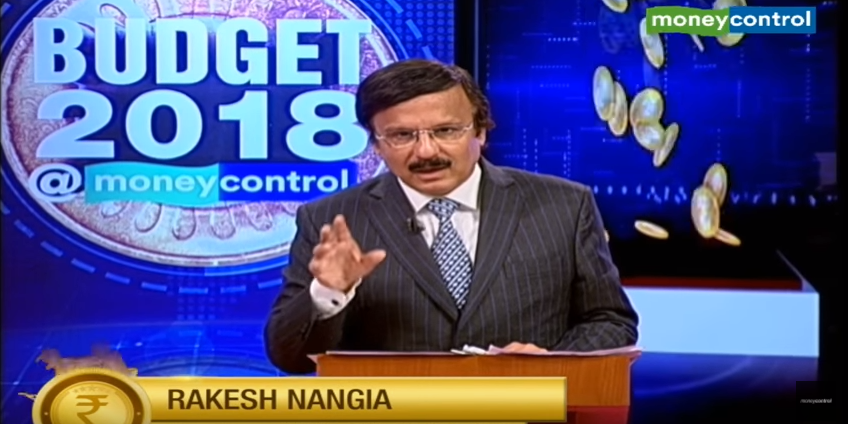

· Mr. Nangia in a special post- budget discussion conducted by Moneycontrol.com(Network 18) discussing Budget impact .

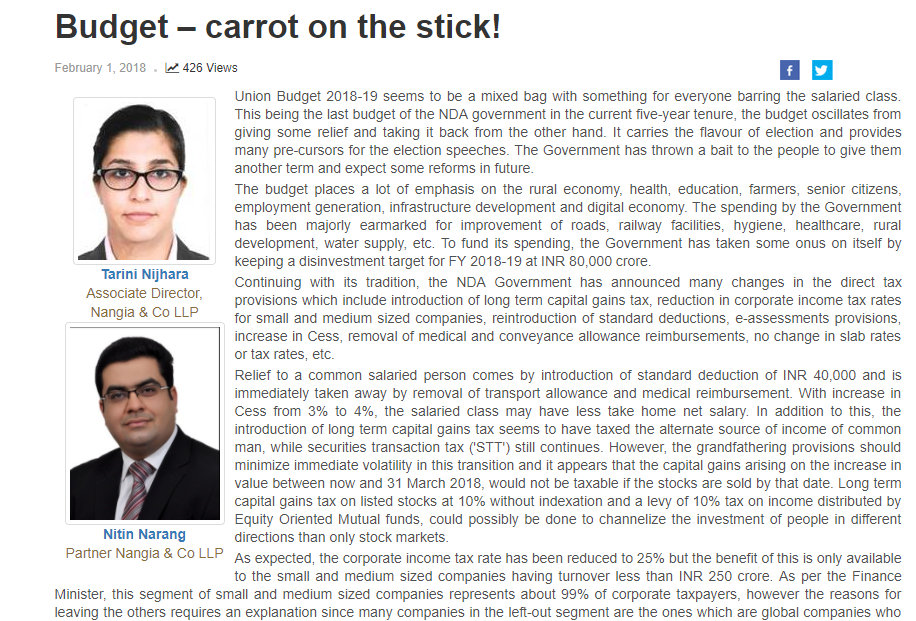

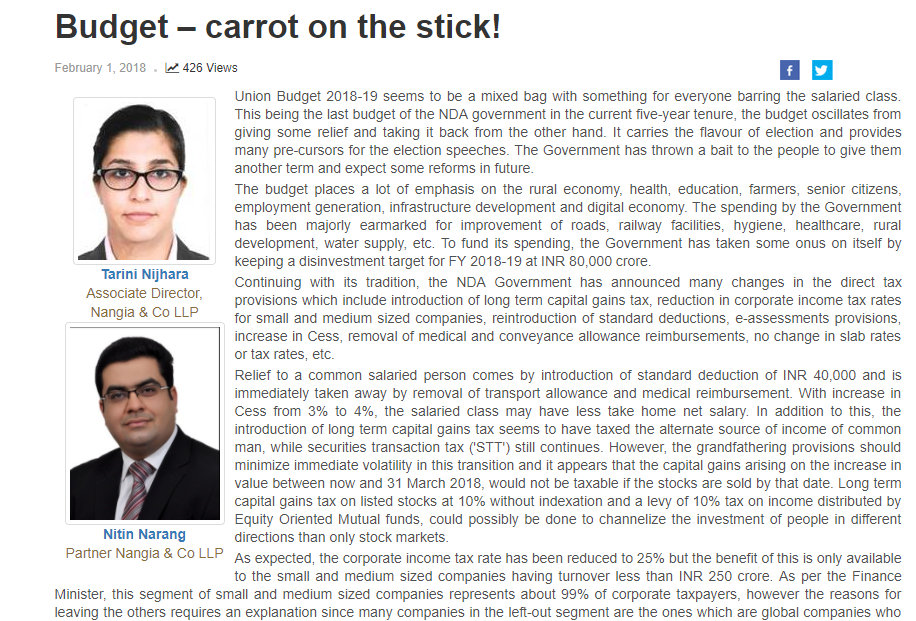

· Nitin Narang, Partner and Tarini Nijhara, Assosiate Director contributed an article on Budget – carrot on the stick! for Taxmann.