Get in touch with Experts

Vikas Gupta

Partner

Vikram Pratap

Partner

Prateek Agarwal

Partner

Our Service Offerings:

Services we offer:

Recording of transactions: Our team of professionals keep record of all financial transactions of the business. We record the transaction in a financial accounting software, which is most suitable to the client needs. Our services include:

-

- Designing accounting procedures specific to client needs.

-

- Recording/posting of Journal entries and maintenance of different general ledgers following uniform chart of accounts. Prepare a list of open items that require additional information / clarification from the clients.

-

- Prepare periodic financial statements and corresponding work papers to facilitate overall review process.

Monitoring and bookkeeping of borrowings:

-

- Our services include reviewing the borrowing agreements from bank and other parties and assess whether terms and conditions given therein are not prejudicial to interest of your organization. We can assist you in preparing repayment schedules for different borrowings. Our professionals can also guide in segregation of borrowings into secured and unsecured, short term and long term, recording and calculation of interest on respective loans and review of any excess penalties or interest being levied by the bank or other party.

Expense management:

-

- Our Outsourced Accounting Services team can assist your company’s management team in defining and setting up digital expense management processes eliminating manual interventions. Our process helps facilitate digital approvals including back-end checks that helps reduce risk of error and fraud.

Payroll accounting:

-

- We offer end-to-end payroll processing services through a state-of-the-art, web-enabled payroll solution. We not only offer a safe and secure data processing, but our team of experts also helps businesses to manage issues arising in labour law area. We collaborate with clients to help them to overcome their payroll, tax and statutory challenges. Our support team brings in knowledge from multiple competencies, including human resources, statutory and legal services, and international and domestic taxation. Our team has solid practical experience in managing issues arising from the labour matters, helping businesses in their relations with employees, trade unions and state authorities.

Services we offer:

Financial Evaluation:

Our team of experts provides you a deep evaluation of your business areas/projects which benefits you in better understanding of your business.

Accounting Process Re-engineering:

Our team of experts, map and analyze current state of your finance and accounting operations, find gaps, suggest improvement opportunities and re-design your processes wherever required.

Budgeting:

We can assist you in various types of budgeting like cash flow budget, sales budget, marketing budget, expenditure budget, depending upon your needs which can help you in meeting you short term goals.

Financial Planning:

We can assist you in financial planning for your business that forecasts realistic steps you can take, as new opportunities arrive and managing risks of your business.

MIS Reporting:

We can provide you with a set of reports that give a view of day-to-day business activities which allows you to analyze your business operations.

Designing Strategy:

Our services include designing of strategies which are aligned with the goals of the business. We take into consideration the visions, the policies of the business and design the process flow and strategies around it.

Receivable and Payable advisory:

We can assist you in reviewing the contracts with creditors & Debtors to guide you on any unfavorable terms of agreement and suggest better terms to negotiate. We focus on terms of repayments, purchase/sales, discounts, payment cycles, interest penalties in case of default, arbitration in case of issues, so that you can take informed decisions after proper analysis. We can assist you in reviewing the contracts with vendors and customers to guide you on any unfavorable terms of agreement and suggest better terms to negotiate.

Services we offer:

Order processing:

This service involves processing of purchase orders, matching them with requisitions raised by purchasing system, placing orders with selected vendors, tracking of orders, receipt of goods/service.

Invoice receipt, documentation and matching:

This service involves verification of invoice received from vendor. The verification process starts with reconciliation of invoice with purchase order and goods receipt note. This verification process, also known as 3-way matching process, documents and communicates any discrepancy noticed to relevant process owners. We also maintain an electronic database of all Purchase Orders, Goods Receipt Note and Invoices including their approvals which enables easy access for users and helps inn reducing processing time substantially.

Recording and processing of invoice:

This service involves recording of approved invoices into the accounting system. At the time of recording, we also observe withholding tax applicability on each invoice and accurately record it in the system. Processing of invoice for payment takes place post recording of invoice, as per the credit period including its terms and conditions contained in agreement with respective vendor.

Invoice Payment Processing:

This service involves processing solutions to help you make timely invoice payments by scheduling payment runs based on due dates as per contractual terms. Our software-based systems also help improve cash flow and drive additional savings for the business by capturing early payment discounts.

Reporting and tracking:

This service involves submitting various reports to the management like invoice exception report, vendor reconciliation, invoice tracking, vendor ageing, vendor agreement validation, spend management and cash flow analysis.

Services we offer:

-

- Reconciliation of bank account statements and credit card statements with primary data sources and final accounting data.

-

- Invoice matching with ledger and journal entries.

-

- Reconciliation of statutory taxes and levies like goods and services tax & withholding taxes as filed in the statutory returns with the primary data source along with matching of balance in statutory records.

-

- Reconciliation of vendor/customer accounts with the primary data source along with identification of any gap in statutory filings.

-

- Reconciliation of payroll register with primary data source. Reconciling and detecting any gaps in statutory returns filed including but not limited statutory levies reconciliation.

-

- Related party balance reconciliations for group companies.

-

- Sequencing check to identify missing invoices and trails.

-

- Data input in client specific formats by eliminating /adding information as per client needs.

-

- Expenditure reconciliations

-

- Revenue reconciliations between primary accounting sources and financial statements and statutory reporting of revenue under various laws.

Services we offer:

Due Diligence:

Our team of forensic experts uses best due diligence practices to provide you reporting as per your needs which helps in effective analyses. Our due diligence services includes –

-

- Financial Due Diligence

-

- Legal Due Diligence

-

- Tax Due Diligence

-

- Operational Due Diligence

Compliance Review :

Our team of forensic accountants review your accounting system and procedures, assess risk and take necessary measures to mitigate it and identify exposures, to prevent violations in compliance.

Fraud Investigation Services :

We can provide investigation services to address any fraud or any other malpractices within ongoing within your organization.

Support in Litigation:

We can assist you in providing support to your legal advisors related to forensic accounting, fraud detection and data analytics.

Services we offer:

-

- Reconciliation and maintenance of audit records.

-

- Understanding auditors technical requirements and queries and arranging information for the same.

-

- Direct interaction with the auditors to understand their grievances and providing timely solution.

-

- Regular review of internal controls to assist management to lower risk fraud and errors.

-

- Preparation of financial statements, notes and schedules in an audit ready format.

-

- Updating the financial information with latest updated and already existing pronouncements.

-

- Keeping a check on information exchange processes between company and auditors by preparing audit trackers and sharing details accordingly.

Services we offer:

-

- Submission of annual/quarterly and monthly statutory returns under various laws.

-

- Maintenance of Statutory registers including but not limited to inventory and fixed asset registers.

-

- Regular updated reconciliation of the statutory returns data with the books to help in audit processes also.

-

- Timely assessing any changes in the statutory laws and providing its direct impact on the business.

-

- Payroll processing and HR statutory compliances.

Services we offer:

-

- Compiling weekly/monthly/Quarterly/Yearly Financial Reports as per client’s need and requirements.

-

- Identifying key Performance Indicators (KPI) and their deep analysis to identify any problem areas that needs to be fixed.

-

- Trends Analysis (Future and past) of reports for timely identification of any unusual patterns.

-

- Suggestions to correct/rectify any abrupt trends in the financial information and its in detailed analysis to check its impact on profitability and growth.

-

- Reviewing the Variance Analysis to understand the reasons for shortfall in achieving the targets and recommendations to rectify the same.

-

- Suggestion of best methodology by evaluating different scenarios to derive the best outcome using “What if analysis”

-

- Better planning and budgeting by regular updation of standards and budgets based on industry trends and review of client historical financial information.

Data Security

Data security is one of the principal concerns for organizations today. For organizations to be able outsource any of their functions to a third-party, security of sensitive data is one of the most paramount concerns to address for a successful partnership. Data security includes data privacy and information security. We assure you that we have developed the skills and established processes to ensure that we deliver the quality and security required by the engagements we support. Committed to protect information assets, personal data and client information from un-authorized collection, retention, use, disclosure, modification, or destruction. Data security includes data privacy and information security. Committed to protect information assets, personal data and client information from un-authorised collection, retention, use, disclosure, modification or destruction. The policy contains the following:

- Includes providing information, guidance and training for employees

- Knowledge management for IT awareness & data protection to ensure timely redressal of potential threats and incident prevention, mitigate the threats posed by cyberattacks

- Based on ISO 27001

- Continually reviewed, vetted and approved by the firm’s senior management to ensure that it correlates to legal or regulatory requirements

- Maintain the security of information through the protection of our technology resources and assets

- Response and system recovery to our critical business environment is carefully planned and tested

- Incorporates mission-critical disaster recovery plans built on industry – leading standards, support from certified disaster recovery planners, regular testing of disaster recovery plans to ensure operational readiness

- Conduct several forms of third-party audit covering various aspects of system control, data privacy network sharing, network vulnerability, application security and infrastructure security

- Confidentiality of information ensured that is acquired as a result of professional and employment relationships

- Confidential Information not used for any reason or purpose other than as necessary in regard to the purpose of the engagement

- Information retained at the engagement team level

- Information shared using a password protected pen drive or external hard drive. In case, information is shared via emails then only official email addresses are used

- No information disclosed to third parties without proper and specific authority unless there is a legal or professional right or duty to disclose

- No Information shared within other verticals of the organization without specific approvals from the client

- Client-serving personnel are strictly prohibited to trade in the securities of clients while working and for a period of six months after the completion

- Partners are prohibited from holding a financial interest

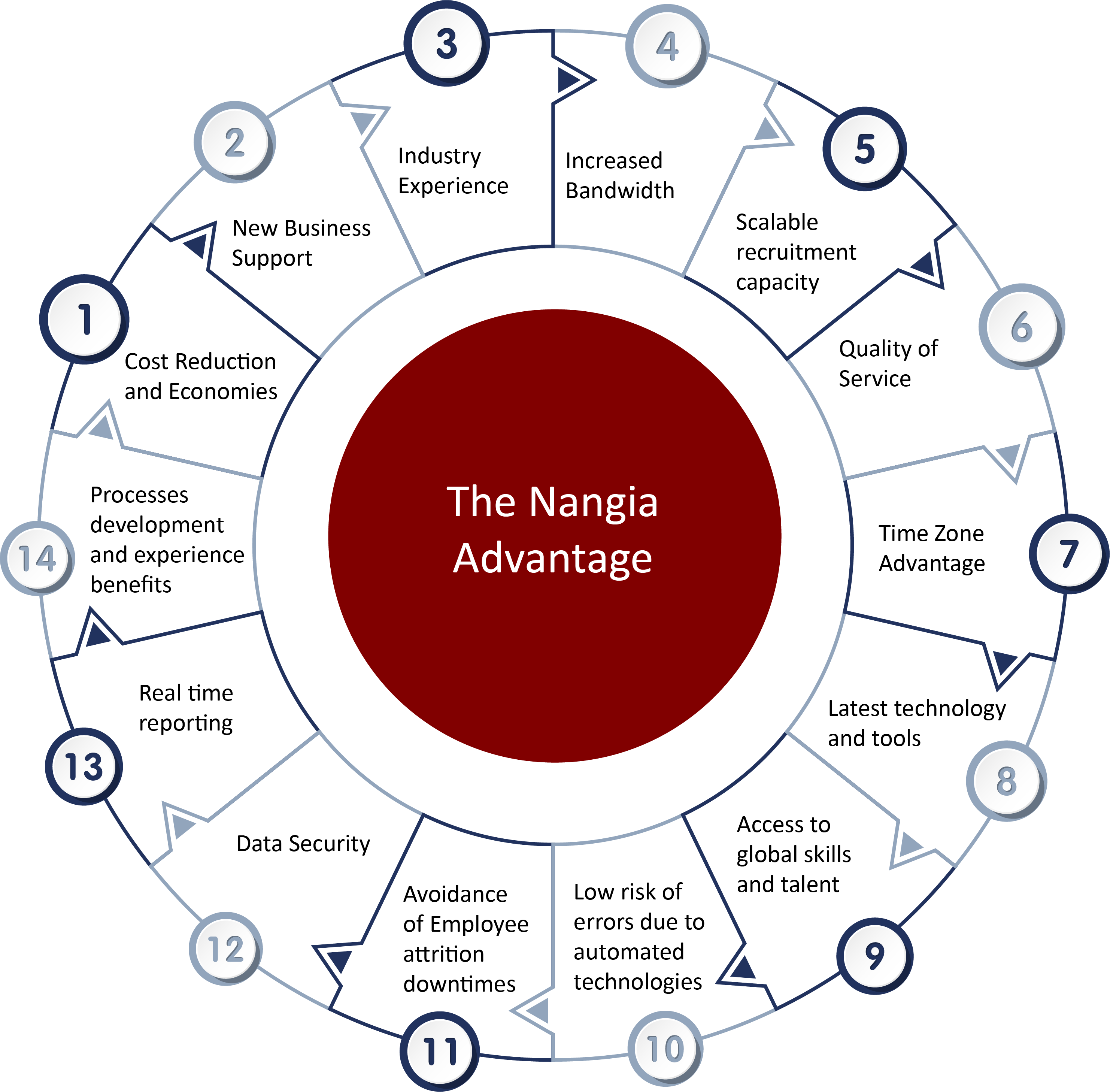

The Nangia Advantage

Our outsourcing model helps reducing costs to as far as 30% to 40% and more importantly without any reduction in quality. The saving end up being considerable since we are able to offer premium services at lower costs due to economies of established processes and operating procedures and decades of experience.

Many small businesses, start-ups, entrepreneurs, growing organizations find it challenging to create an accounting and compliance team to manage its bookkeeping, bank account operation, payment and collection processes, reporting mechanisms during their inception stages which is where we put small and emerging businesses on the same accounting and reporting platform of larger businesses and organizations helping them grow and focus on strategic business while we cater to their accounting, compliance and reporting needs.

We have served multiple businesses from startups, MSMEs, large corporate houses and multi-national giants with their financial, accounting and outsourcing requirements.

Outsourcing tasks like bookkeeping, accounting and management reporting help you to focus your time and energy on business strategy and growth. Experience analysis suggests that CFO tends to get 25-30% additional time to focus on bringing more revenue, innovation, networking and value addition when they have to focus less on managing accounting functions.

We offer you a recruitment plan customized to your specifications with the flexibility to up and down scale to meet your requirements and manage expenditure. We have a substantial workforce pool that allows you to scale your services significantly without any lag without the need to go through a rigorous recruitment process.

We offer a high-caliber, high-quality service to every client and every project. 80% of our business comes from client referrals and over 90% of our clients renew their services annually with us.

We offer a critical time zone advantage wherein our process and delivery is synchronized to every major global time zone. This allows our clients to function under the convenience of their business hours. Working with onsite and remote professionals, especially offshore resources, lets you take advantage of the different time zones and you can rest assured of round-the-clock development of the assignment, ensuring a faster time-to-market.

We execute our deliverables in platforms built with best-in-class, innovative, and robust technology. Our processes are automated; our cloud-based accounting portal allows for better collaboration within the organization and with our clients,thus helping clients achieve better response times and increased data accuracy. Our accounting and bookkeeping processes can reduce our clients’ monthly workload by 20%-30%, depending on the project. We replace dated, manual, and untimely bill collection and submission functions with proven, automated systems that align with the unique needs of our clients. Further as technology evolves, we offer a fast-tracked and glitch free migration.

We allows you to choose the sourcing strategy best suited for your business needs from our diverse resource pool through an analysis to identify the size, work volume and complexity involved, to rationalize shift model and rotation for support service team. We give you the opportunity to hire a professional with a higher level of expertise at an affordable price as well as give you access to the complete knowledge base of our entire team even though you might be associating with one. We have a robust program to keep improving skills, knowledge and qualifications to stay abreast of the global market.

Accounting service automation does not only save time, but it also reduces risks by minimizing human errors. Real time reviews and monitoring assist in identifying potential glitches and redressal at an early stage. With minimum internal interreference the risk of frauds and pilferage are also significantly mitigated.

Our outsource functions leverage you against accounting team attrition and work-flow transitions. Our multi-level engagement team structure also safeguards you from attrition at our team level. Employee attritions also leads to secondary costs and lags for training and bringing new workforce up-to speed. All these mechanics are already built into our systems thereby providing our clients a seamless workflow.

Accounting information safeguard and security is one of the primary apprehensions of internal data management as well as businesses outsourcing functions. We acknowledge the fact that it is difficult for small to mid-sized businesses to build a dynamic environment to keep their data and client data safe. At Nangia and Co. LLP we put a significant emphasis on securing sensitive financial data and other personal information. We follow more than 25 security checkpoints and strict protocols to keep our client data safe.

We understand the time sensitivity of sharing financial information and how critically it impact management decision making. We believe in designing an MIS structure specific to each engagement catering to specific client needs.

We bring a 40+ year process development experience to your doorstep. We have catered to every industry and service customer over our decades of accounting and process support service record. We not only offer a tested and established network of processes but also give you the flexibility to modify each process to your specific needs or even develop one from scratch. We have a coordinated developer team of Industry leaders in fields of Accounting, Forensics, Cyber Security, IT security,